-

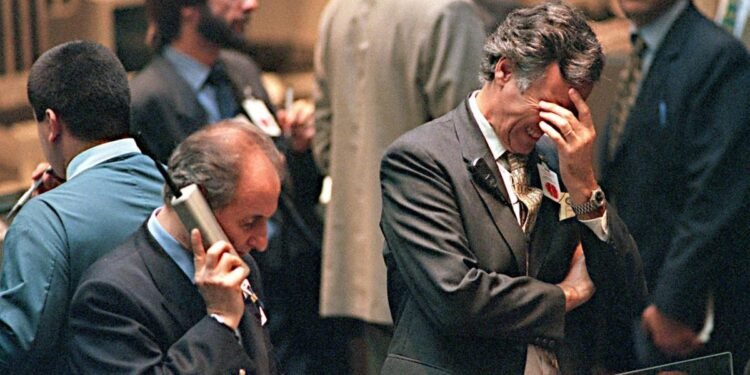

John Hussman, an asset-bubble expert, forecasts the ongoing rally in US stocks will “end in tears.”

-

The S&P 500 risks a 64% collapse given extreme valuations and “unfavourable market internals,” he said.

-

Here are the long-time market bear’s six most striking quotes from a recent note.

The US stocks have enjoyed an impressive rally in 2023, thanks to a combination of cooling inflation, fading recession fears and hype over artificial intelligence.

But don’t bet on the cheer lasting long, according to John Hussman.

The long-time equity bear who called the 2000 and 20008 crashes recently doubled down on his grim outlook for US stocks, warning of an astonishing 64% plunge in the S&P 500 index that’ll burst what he called an “extreme yield-seeking speculative bubble”

The president of Hussman Investment Trust has based his views on stretched equity valuations and unfavourable “internals” – deeming a steep plunge in stocks necessary to restore market conditions back to normal.

The S&P 500 has rallied 19% so far this year, taking its gains since the end of 2008 – the year of the global financial crisis – to more than 400%. The price-earnings ratio of the index, one of the valuation metrics tracked by investors, has climbed to about 26 from last year’s lows near 19, according to data from macrotrends.net.

Here are Hussman’s six most striking quotes from a recent note.

1. “There is a particular ‘setup” that we’ve historically found to be associated with abrupt ‘air pockets’ and ‘free falls’ in the S&P 500. It combines hostile conditions in all three features most central to our investment disciple: rich valuations, unfavourable market internals, and extreme overextension.”

2. “The present combination of historically rich valuations, unfavorable internals, and extreme overextension places our market return/risk estimates – near term, intermediate, full-cycle, and even 10-12 year, at the most negative extremes we define.”

3. The potential for a near-term ‘air pocket’ or ‘free fall’ isn’t a forecast so much as a regularity that should not be ruled out. Likewise, with valuations again higher than at any point in history prior to December 2020, with the exception of several weeks surrounding the 1929 peak, the potential for a much steeper follow-through should be taken seriously.”

4.“At present, the valuation extremes we observe imply that a -64% loss in the S&P 500 would be required to restore run-of-the-mill long term prospective returns. I know. That sounds preposterous. Then again […] I’ve become used to making seemingly preposterous risk estimates at bubble peaks.”

5. “Despite enthusiasm about the market rebound since October, I remain convinced that this initial market loss will prove to be a small opening act in the collapse of the most extreme yield-seeking speculative bubble in U.S. history.”

6. “Yes, this is a bubble in my view. Yes, I believe it will end in tears.”

Read the original article on Business Insider