- ➡️ Bhutan’s $22M Bitcoin liquidation highlights the financial pressure on industrial miners due to rising difficulty and costs.

- ➡️ As L1 spot prices face sell pressure, capital is rotating into infrastructure projects that solve Bitcoin’s scalability limits.

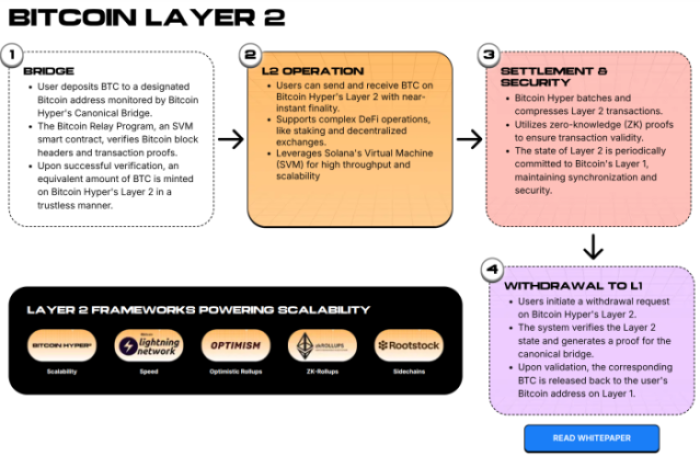

- ➡️ Bitcoin Hyper uses the Solana Virtual Machine to deliver high-speed, low-cost smart contracts while securing data on Bitcoin L1.

- ➡️ $HYPER has raised over $31M so far with smart money positioning heavily in the $HYPER presale.

Sovereign volatility is back. On-chain data confirms that a wallet linked to the Royal Government of Bhutan, managed by Druk Holding & Investments, recently deposited 367 $BTC to Binance. That movement, valued at approximately $22M, isn’t an isolated event. It’s a symptom of a brutal squeeze in the mining sector.

With Bitcoin’s hash price compressing and operational expenditures (OpEx) for industrial miners climbing, even state-backed entities are liquidating reserves to keep their balance sheets healthy.

The market reaction? Mixed. While a $22M sell wall is absorbable in today’s high-volume environment, the signal is undeniably bearish for short-term Layer 1 price action. It highlights the growing tension between network security costs and miner profitability.

But smart money rarely sits on its hands. As capital rotates out of stagnant spot positions, sophisticated investors are hunting for yield in the emerging Bitcoin Layer 2 ecosystem, a sector designed to solve the scalability issues currently choking the main chain.

This rotation is visible in the flows toward infrastructure projects, unlocking Bitcoin’s dormant capital. Leading the pack is Bitcoin Hyper ($HYPER), a protocol using the Solana Virtual Machine (SVM) to bring high-speed execution to the Bitcoin network.

Bitcoin Hyper ($HYPER) Brings SVM Speeds To The Oldest Blockchain

Bitcoin has a utility problem. While it remains the pristine collateral of the crypto world, let’s be honest, it’s sluggish. Transactions crawl, fees spike during congestion, and programmable smart contracts are virtually non-existent on the main chain. Bitcoin Hyper ($HYPER) tackles this by grafting the Solana Virtual Machine (SVM) directly onto the network as a Layer 2 solution.

This architecture allows Bitcoin Hyper to process transactions with Solana-grade speeds while anchoring security to Bitcoin’s Layer 1. For developers, this opens the door to building DeFi apps, NFT platforms, and gaming dApps using Rust, all within the Bitcoin ecosystem.

Bitcoin Hyper uses a decentralized Canonical Bridge to ensure trustless $BTC transfers, effectively turning static Bitcoin into a productive asset.

That matters for adoption. By modifying SPL-compatible tokens for L2 execution, Bitcoin Hyper creates a high-speed payment and DeFi environment that Bitcoin has historically lacked. The protocol operates on a modular framework: Bitcoin L1 handles settlement, while the SVM L2 handles real-time execution.

This separation of concerns allows a single trusted sequencer to manage throughput without compromising the underlying security guarantees of the Bitcoin network.

LEARN MORE ON THE OFFICIAL $HYPER PRESALE PAGE

Whales Accumulate As Smart Money Front-Runs The L2 Narrative

While sovereign miners like Bhutan sell to cover costs, a different class of investor is aggressively accumulating early-stage infrastructure. The data surrounding the Bitcoin Hyper presale suggests serious institutional confidence. According to official figures, the project has already raised over $31M.

This liquidity injection isn’t just retail money. Etherscan records show that whales are also in on the action, with one wallet scooping up $500K’s worth of $HYPER. This data point, large singular buys rather than thousands of micro-transactions, indicates that high-net-worth individuals are positioning themselves before the token hits public exchanges.

With the current token price sitting at $0.0136751 and staking rewards at 68%, these entities are securing positions at a valuation that anticipates major future utility. Our experts also predict $HYPER doing well, possibly making it to $0.32 by the end of 2026. If that happens and you’d invested today, it’s an ROI of 2240%

The incentive structure supports the long game, too. Bitcoin Hyper offers high APY staking immediately after the Token Generation Event (TGE). Notably, the protocol enforces a 7-day vesting period for presale stakers. This mechanism (often overlooked by retail flippers) is designed to prevent immediate post-launch dumping, stabilizing the price floor while rewarding those who participate in governance.

For investors watching Bhutan sell L1 assets, rotating into a yield-bearing L2 represents a hedge against mining-induced volatility.

GET YOUR $HYPER ON ITS OFFICIAL PRESALE PAGE

This article is for informational purposes only and does not constitute financial advice. Cryptocurrencies are high-risk assets. The mention of specific dates, such as January 15, 2026, reflects data provided by the project source. Always conduct your own due diligence before investing.

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.