Growing investment concept Ghing

When executed properly, the dividend growth investing strategy can help mom-and-pop investors to achieve financial independence. For clarity, I define this as the point at which passive income exceeds expenses for an investor.

One quality stock that is a core utility holding within my portfolio is the electric utility, American Electric Power (NASDAQ:AEP). For the first time since last May, I will elaborate on American Electric Power’s (after this known as AEP) fundamentals and my fair value estimate of the stock.

A Sustainable, Market-Topping Payout

Compared to the average respective 1.65% and 3.41% dividend yields of the S&P 500 index and the regulated electric utility industry, AEP’s 3.61% dividend yield is intriguing. And the good news is that this dividend seems to be viable moving forward.

This is because AEP logged $5.09 in operating EPS in 2022. Against the $3.17 in dividends per share paid during the year, this equates to an operating EPS payout ratio of 62.3%. Along with debt and equity issuances, this payout ratio leaves the company with enough capital to continue upgrading and expanding its electric utility infrastructure to support a growing business.

This payout ratio is also positioned to remain in the low-60% range for 2023: AEP anticipates that it will generate midpoint operating EPS of $5.29 ($5.19 to $5.39) in 2023. Stacked against the expected dividend per share obligation of $3.37 (assuming a Q4 dividend per share of $0.88), this would be equivalent to a 63.7% operating EPS payout ratio.

Over the long haul, I predict that the company’s operating EPS payout ratio will hang around the low- to mid-60% range. Seeing as AEP believes that it will deliver 6% to 7% annual operating EPS growth in the long run, I am confident in reiterating my 6.25% annual dividend growth rate from my previous article on the stock.

Unusually Mild Weather Weighed On First-Quarter Results

AEP Q1 2023 Earnings Press Release

Earlier this month, AEP shared its financial results for the first quarter of 2023 ended March 31.

The utility’s operating revenue rose by 2.2% year over year to $4.7 billion in the quarter. AEP’s total normalized gigawatt hours or GWh sales increased by 3.3% during the quarter. These results were driven by commercial and industrial normalized GWh sales growth rates of 7.8% and 5.1%, respectively. This implies that AEP’s commercial and industrial customers are still doing fairly well despite the slowdown in growth in recent months. These results were partially offset by weakness among residential customers, which led to a 1.4% decline in normalized GWh sales growth rates among that customer group (all details according to AEP Q1 2023 earnings press release and slide 11 of 35 of AEP 1st Quarter 2023 Earnings Release Presentation).

AEP’s operating EPS fell by 9.1% over the year-ago period to $1.11 for the first quarter (info per AEP Q1 2023 Earnings Press Release). At first glance, this performance would appear to be discouraging. But as CFO Ann Kelly explained in her opening remarks during AEP’s Q1 2023 earnings call transcript, the weather in the first quarter was quite mild. How mild was it? Kelly pointed out that in observing historical weather patterns in the last 30 years of first quarters, there was only one quarter with weather milder than the first quarter of 2023. Nearly unprecedented weather patterns in the first quarter are why I’m still a believer in the company, even with its operating EPS contraction during the quarter.

Risks To Consider:

AEP is an excellent business. But investors need to be aware of the risks facing the company, regardless.

While AEP’s commercial and industrial customers are holding up well thus far, that could change at the drop of a hat. If the economic slowdown proves to be worse than expected, this could negatively impact demand from these customers. That could harm AEP’s results in the near term.

The electric utility’s growth forecasts largely depend on its ability to fund $40 billion in capital expenditures over the next five years (info per slide 5 of 35 of AEP 1st Quarter 2023 Earnings Release Presentation). If the company can’t bridge the gap between its retained earnings and capital expenditures on reasonable debt and equity terms, the utility may need to rethink its capital expenditure plan. Such an event could hurt AEP’s growth potential.

The Price Is Right For AEP

Just as picking great businesses is an important part of investing, not overpaying is just as important. That is why I will use two valuation models to try to appraise the value of AEP’s shares.

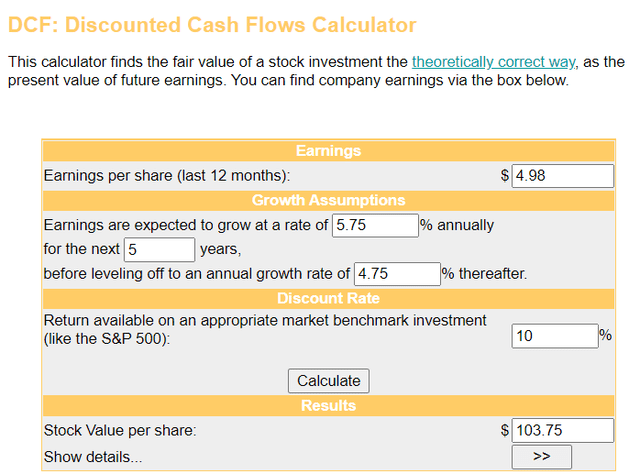

The first valuation model that I’ll utilize to estimate the fair value of shares of AEP is the discounted cash flows model or DCF model. This consists of three inputs.

The first input into the DCF model is trailing twelve-month earnings. That amount is $4.98 in operating EPS in the case of AEP.

The second input for the DDM is growth assumptions. I will err on the side of caution with 5.75% annual operating EPS growth for the next five years and deceleration to 4.75% annually beyond that time.

The third input into the DCF model is the discount rate. This is simply the annual total return rate required by an investor. I prefer 10% annual total returns, so that is the input that I will be using.

Using these inputs for the DCF model, I arrive at a fair value of $103.75 a share. This suggests that AEP’s shares are trading at an 11.2% discount to fair value and offer a 12.6% upside from the current share price of $92.11 (as of May 5, 2023).

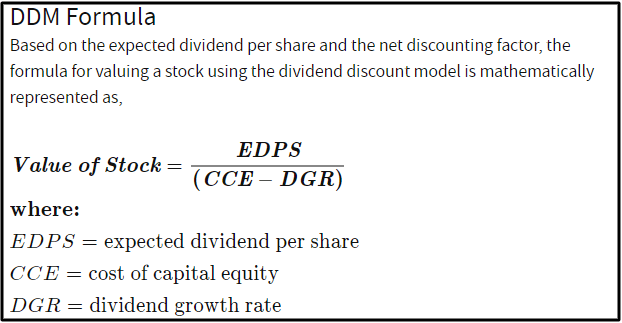

Investopedia

The second valuation model that I will use to approximate the fair value of shares of AEP is the dividend discount model, also known as the DDM. This contains three inputs as well.

The first input for the DDM is the expected dividend per share, which refers to the annualized dividend per share. AEP’s current annualized dividend per share is $3.32.

The next input into the DDM is the cost of capital equity, which is the annual total return rate that an investor requires on investments. I’ll again use 10% for this input.

The final input for the DDM is the annual dividend growth rate. I will use 6.25% for this input.

Factoring these inputs into the DDM, I am left with a fair value of $88.53 a share. This hints that AEP’s shares are priced at a 4% premium to fair value and could face a 3.9% downside from the current share price.

When I average these two fair values together, I compute a fair value of $96.14. That means shares of AEP are trading at a 4.2% discount to fair value and offer 4.4% capital appreciation from the current share price.

Summary: A Top-Notch Utility At A Reasonable Valuation

AEP has boosted its payout for 13 consecutive years, which qualifies it as a dividend contender. The company’s operating EPS payout ratio is fairly modest and operating EPS is expected to keep growing, which should power dividend growth.

Putting AEP’s 3.6% dividend yield and 6% to 7% annual operating EPS growth together, the stock should deliver annual total returns of around 10% in the years to come. This is compelling enough for me to rate the stock a buy for dividend growth investors at the current $92 share price.