In August, the Financial Conduct Authority issued hefty fines to disgraced fund manager Neil Woodford and his company, Woodford Investment Management, of £5.9m and £40m respectively for failures managing the Woodford Equity Income Fund.

These are just two of a string of headline-grabbing fines issued by the regulator over the past few years, including a £42m fine to Barclays Bank and a £21m penalty to Monzo.

Open enforcement operations have declined in the past few years, suggesting that the regulator may have been more targeted in its approach

The FCA has been ramping up the size of its fines, with enforcement data for 2024/25 showing a 337% increase in the total value of its penalties, rising from £42.5m last year to £186.4m this year.

For advisers and their clients, these eye-watering figures may look like justice being served, but they may also raise a question: when the regulator drops colossal fines like this, who receives the money?

Who benefits from FCA fines?

A possibly common misconception is that these large fines – or at least part of them – are ring-fenced to provide compensation for affected consumers. But most of the time this isn’t the case.

However, the money doesn’t go into the regulator’s pocket either. According to the FCA’s Financial Penalty Scheme, all penalties collected are paid directly to the Treasury, minus a sum used for reimbursing the cost of the FCA’s own enforcement action. This means the fines are primarily used for punishment and deterrence purposes, rather than to benefit either the regulator or consumers.

Some firms may be able to obtain a significant reduction on the initial fine if they agree to resolve the matter at an early stage

So, if the fines flow to the Treasury, where does redress for victims come from?

In some circumstances, the FCA can require the offending firm to establish a redress scheme, but this is separate from a penalty fine.

In the Woodford case, for example, the regulator required Link Fund Solutions, the Woodford fund’s authorised corporate director, to establish a £230m redress scheme for distribution to investors trapped in the suspended fund. This was entirely separate from the combined £46m in penalty fines.

What proportion of fines is paid?

Although the headline figures are huge, advisers may wonder if firms actually pay the full amount, or whether some get away with a discount.

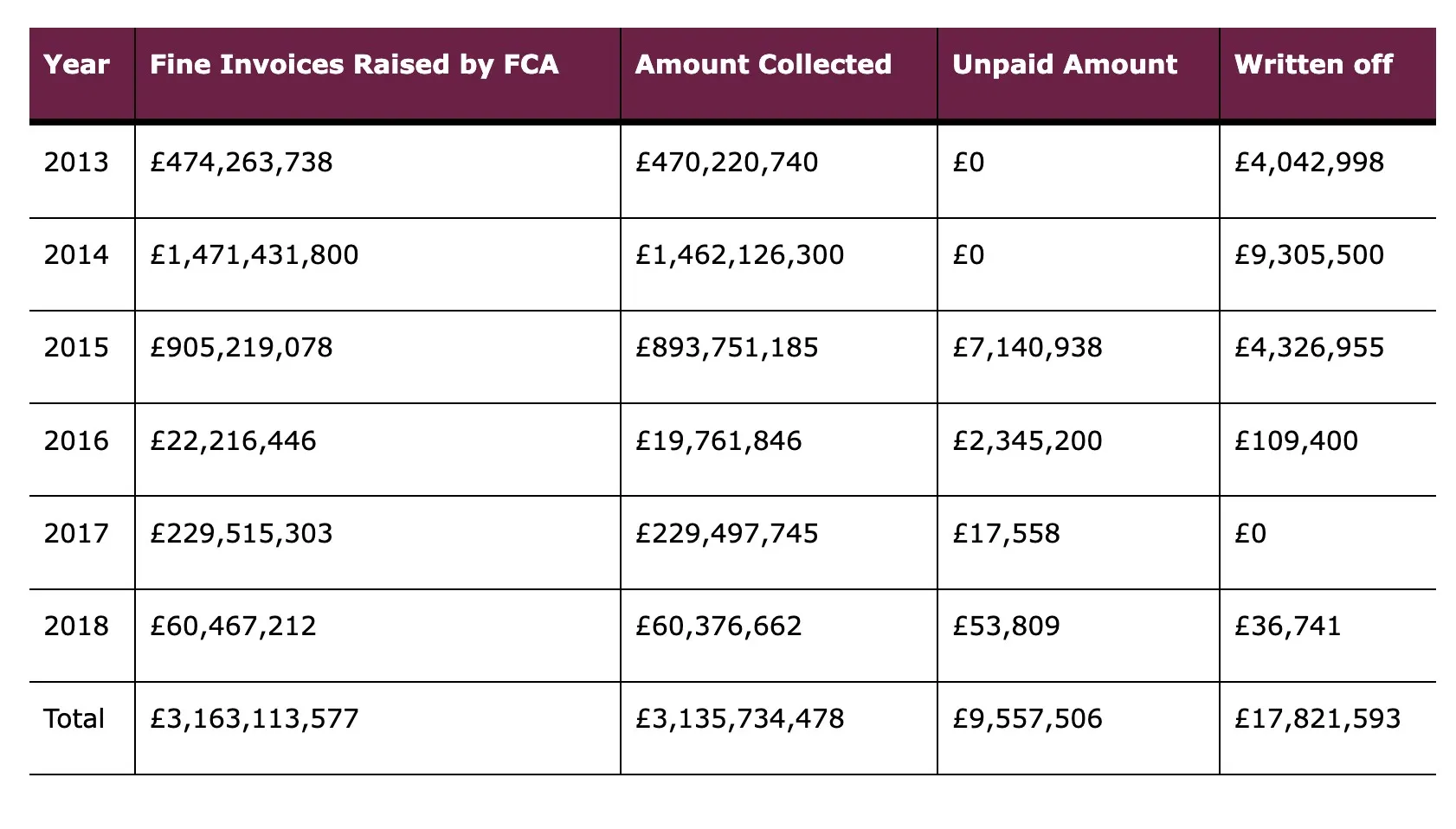

FCA data suggests that most fines are collected, except where firms have ceased to exist or don’t have the assets to pay. In these cases, some fines may be written off.

If the fines flow to the Treasury, where does redress for victims come from?

Figures obtained through a freedom of information request to the regulator show that, in some years, it has collected 100% of fines issued, while in other years it has written off millions of pounds.

However, some firms may be able to obtain a significant reduction on the initial fine if they agree to resolve the matter at an early stage.

Former FCA executive director of enforcement and market oversight Mark Steward has previously said: “There have been several cases in which we have materially reduced our financial penalties on firms in excess of the automatic 30% discount for cases that are fully resolved at stage one.

In some circumstances, the FCA can require the offending firm to establish a redress scheme

“We encourage firms to respond to this incentive by going beyond what we expect and taking immediate, unprompted steps, in consultation with us, to thoroughly and quickly ameliorate harm caused by their conduct failures.”

When a fine needs to be paid, it is usually agreed with the firm on a case-by-case basis and is specified in a Final Notice, according to the FCA.

How many investigations lead to enforcement action?

It is difficult to specify how often investigations lead to enforcement action, but the most recent FCA figures show that open enforcement operations have declined in the past few years, suggesting that the regulator may have been more targeted in its approach.

The number of open operations fell from 188 in March 2024 to 130 in March 2025, while the FCA issued 37 Final Notices over the period and achieved 135 outcomes using its ‘formal intervention’ tools.

The FCA has been ramping up the size of its fines

Although the regulator itself handles high-level enforcement against financial firms and individuals, individual complaints from clients are dealt with by firms in house, or subsequently go through the Financial Ombudsman Service (FOS) if a resolution is not reached.

In 2023/24, around 37% of cases at the FOS were upheld in customers’ favour, while the FCA’s own aggregate data on firm complaints shows that financial firms themselves upheld around 57% of complaints.

In summary, the purpose of the FCA’s penalty fines is punishment and deterrence, while compensation for consumers is usually obtained either through the FOS or via an additional redress scheme.

Laura Purkess is a freelance financial writer